While COVID-19 and your cash might not seem connected at first, the onset of the Coronavirus infection and the rise of cases in Australia has resulted in volatility in stock markets. Michelle Stone from Feel Good Financial Planning shares her comments about what coronavirus means for money

What coronavirus means for your money

Markets are cyclical. Anyone who has ever sat in a meeting with me knows that we often discuss its not a matter of ‘if’, rather ‘when’ markets fall. This is the nature of investing.

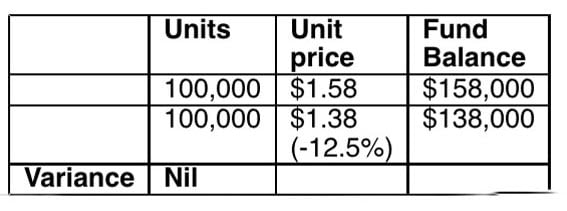

When markets decline, as pertains to a managed fund, you will see the dollar value of your investment go down. But this does not mean that you have ‘lost’ money. It means the price of your units in your managed fund (including superannuation) have gone down.

See example below:

Although the value of your investment declines, as long as you have the same amount of *units*, and do not sell them, you will not lose money.

This is true for many situations, and under current circumstances will help you understand what coronavirus means for your money.

Anyone retired (in draw down phase) generally retains pools of cash for this purpose to avoid crystallising a low unit price in a market downturn.

Those in the ‘accumulation phase’ (that is, not retired) can take advantage of the low unit price when their employer (or self-employed) contributions are invested, taking advantage of the discounted price and being able to purchase more units. This will set you up to benefit even further when the market recovers.

Markets are cyclical, and coronavirus means changing how you understand your money

There’s a lot you can do to protect or improve your finances. Make sure you’re up to date on everything relevant to your situation, (such as changes to Insurance: Income Protection Policies in 2020) and work out your financial goals.

Need more finance advice? Find out more from Feel Good Financial Planning or see their website here.

Find out more about Michelle Stone on her Business Spotlight profile.

Disclaimer: The views expressed in this publication are solely those of the author; they are not reflective or indicative of Financial Services Partners position and are not to be attributed to Financial Services Partners. They cannot be reproduced in any form without the express written consent of the author. The information provided in this document, including any tax information, is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. Financial Services Partners Pty Ltd ABN 15 089 512 587, AFSL 237590